Toolkit

-

-

-

-

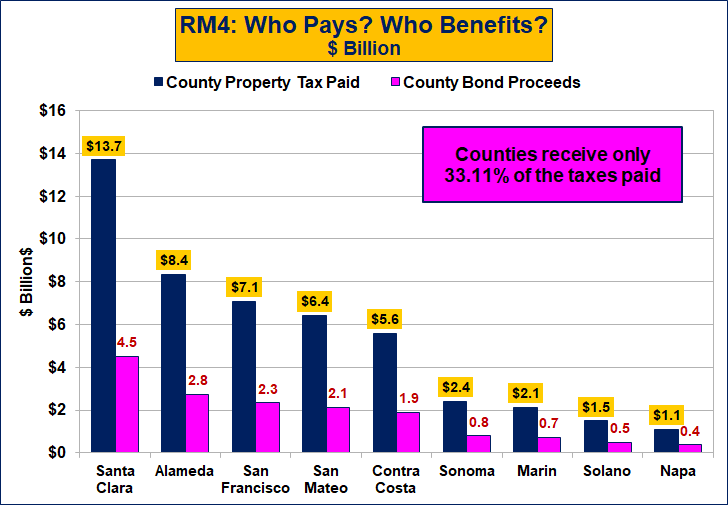

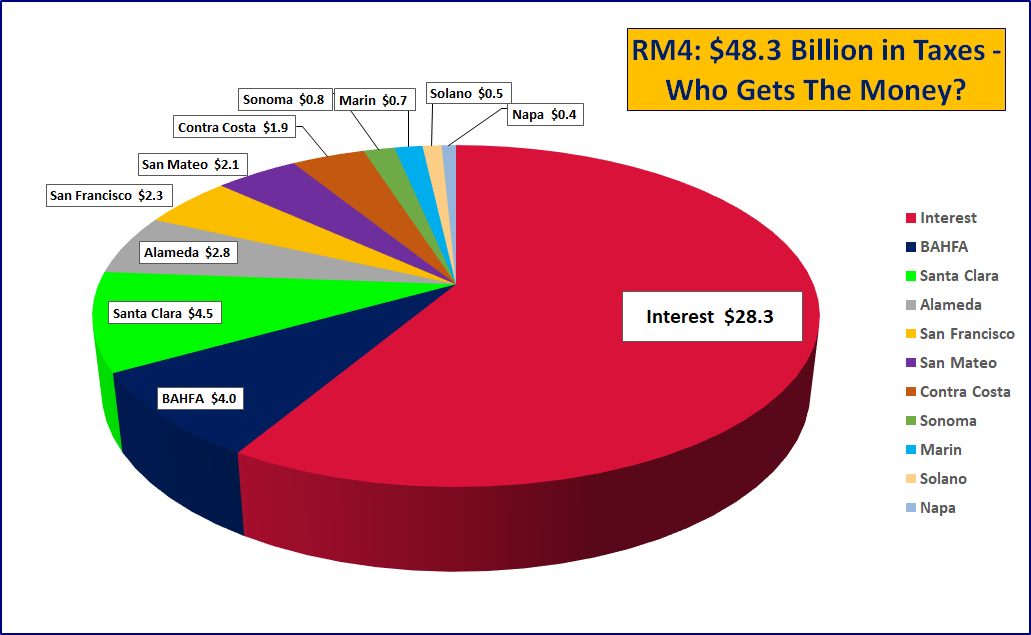

RM4 Use of Proceeds

How $48.3 Billion in taxes will be spent: for interest payments, BAHFA, and each of the nine counties.

-

-

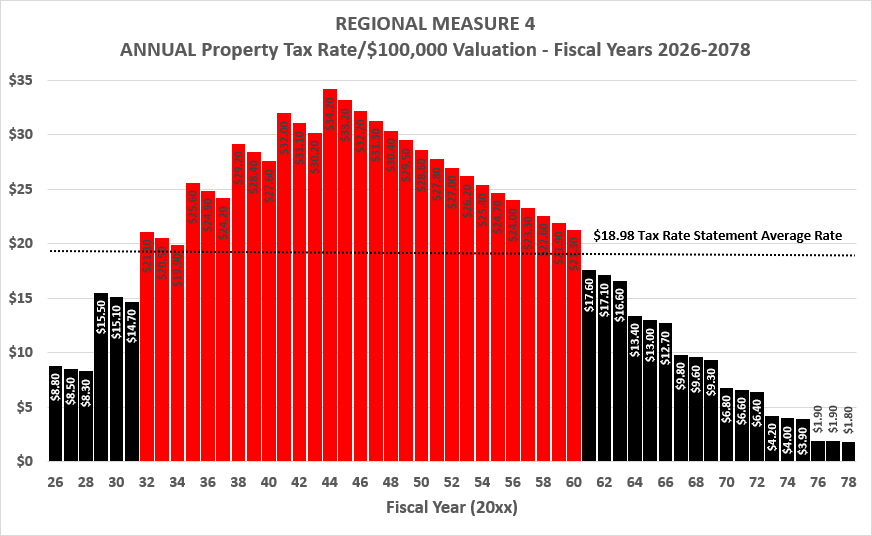

RM4 Annual Tax Rate

Annual property tax rates for 53 years (2026-2078). Rate peaks at $34.20, and most years exceed the publicized average rate of $18.98 .

-

Meaningless Bond Oversight Committee

METROPOLITAN TRANSPORTATION COMMISSION/BAY AREA HOUSING FINANCE COMMISSIONBAY AREA RM4 $20 BILLION HOUSING BOND BALLOT MEASUREMTC MUST NOT BE ALLOWED TO CREATE A MEANINGLESS CITIZENS’ BOND OVERSIGHT COMMITTEE SUMMARY As part of its effort to encourage the Bay Area electorate to approve its Regional Measure 4, a $20 billion bond series for affordable housing to be…

-

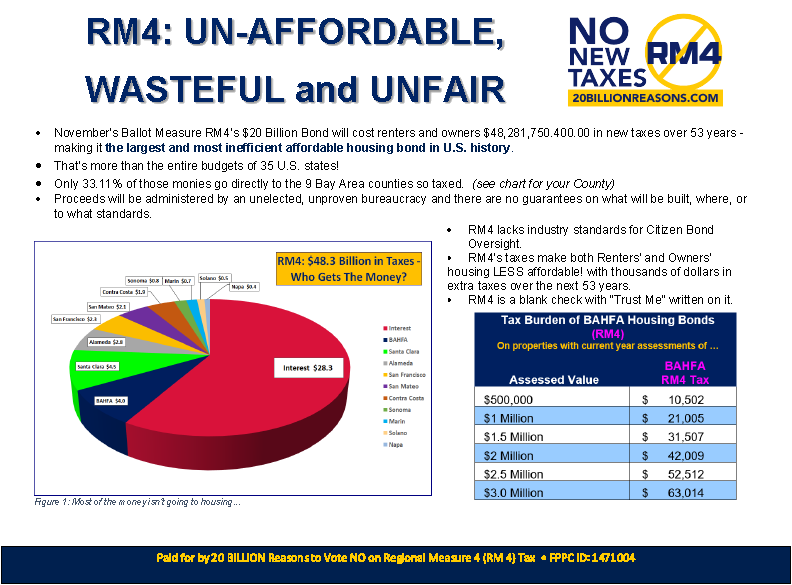

WASTEFUL HOUSING TAX

$48.3 Billion in New Taxesover 53 years! Only 33% goes to Housing Wastes $32.3 Billion on Bond Interest and Bureaucratic Overhead Vote NO on RM4!

-

-

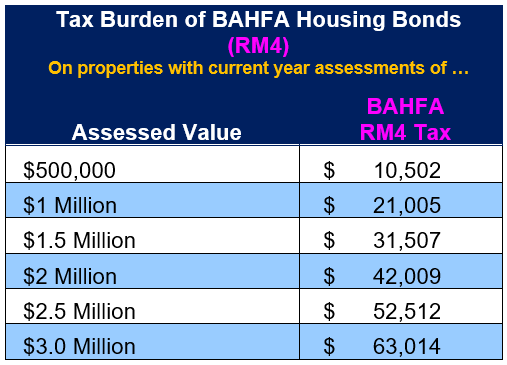

UN-AFFORDABLE HOUSING TAX

$42,000 in extra taxesfor a new median-priced home No exemptions for Seniors No exemptions for Disabled RM4 Makes You Poor! Vote NO on RM4